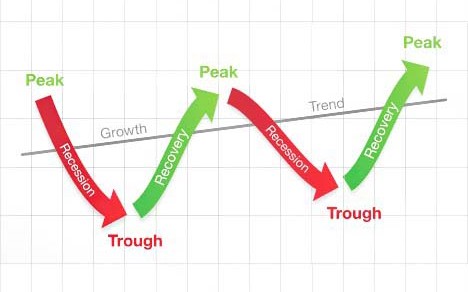

Understanding V, U, W, and L Shaped Recessions

The German News TV channel website published an article on May 24, entitled “These are the four scenarios of the Great Recession.” The article believes that the economic decline that people are facing is unprecedented. Since 2020, Dow and the S&P have been triggered circuit breakers that halted trading for four times. Compared with the previous one in 1997, the situation has deteriorated this year. In many countries, after gradually lifting lockdown of the city, the economy was also affected. Understanding V, U, W, And L shaped recessions may help you know more about the situation we are in.

Case 1: V-shaped recession

The “V” shape is the most optimistic situation. The most typical case is the bankruptcy of Lehman Brothers ten years ago. The recession period of this situation may last for three or four quarters. That is to say, from the first quarter to the third or even the fourth, the GDP of the will decline sharply. After the economy is hit by the lockdown of the city, the government’s stimulus plan will bring to a growth in consumption and investment. The economy will recover strongly by the end of summer or autumn. The economic growth rate for the whole year of 2020 will still be negative, but the V-shaped recovery can be clearly seen from a series of data. Such recovery has benefited from the huge rescue plan. However, the premise is that the national rescue plan avoids a lot of bankruptcy and mass unemployment.

At present, most countries and regions gradually lift the lockdown. However, not all regions are lifted at the same time. In general, the pressure on the global economy will continue. Some parts of Asia and Europe may slowly return to normal in a few weeks, but the road for US recovery is more rugged by chaotic crisis management and a series of sudden riots. And the global integration of supply chains may continue to hinder production.

Case 2: W-shaped recession

A rebound situation may be a “W” shape. In this case, the economy will recover quickly, but then it will stagnate or fall again. For example, the epidemic will break out and the city will be locked down again in autumn. Therefore, it is very important that the strategy of the lockdown the city to control the virus effective, and that lift the lockdown should not be hurried.

Case 3: U-shaped recession

In this case, the economy may experience a longer period of crisis before a slow recovery, and it will not recover before 2021. The first reason is the long-term burden caused by the epidemic. Another reason is that as a long-term consequence of the lockdown, economic problems will appear over time. For example, the bailout plan did not work as expected, leading to a downward spiral of the economy. A large number of companies went bankrupt. More and more people were laid off and unemployed. The consumption continued to decline. New industries were subsequently affected, and new layoffs followed.

It is sure that the rescue plan adopted to mitigate the impact of the lockdown will lead to a significant increase in government debt. This may trigger another crisis in the medium term, thus prolonging the economic difficulties.

In theory, the rapid calmness of the epidemic and the correct countermeasures of the government and the central bank can avoid this spiraling crisis escalation. But people often cannot tell when the financial crisis will come. Economist Nassim Taleb coined the term “black swan” for this purpose. The coronavirus itself is such a black swan. Subsequent financial crises may also follow this model.

Case 4: L-shaped recession

The “L” shaped recession is the worst case. This situation will plunge into a long-term depression for many years. The reason for this situation may be that the virus cannot be controlled for a long time, or because of a systemic economic crisis in one or more economic zones. For example, the US economy experienced a severe spiral decline due to massive unemployment.

Of course, the emergence of the L-shaped situation must be affected by many adverse factors. This kind of extreme situation occurs only when there are problems in almost every aspect. Although this situation cannot be completely ruled out so far, most economists believe that this situation is unlikely to occur. Instead, a “V” or “U” shaped recession is more likely. Governments in many countries have responded quickly and implemented effective rescue programs. After all, the crisis does not stem from the economic system itself. If the pressure factors caused by the new crown epidemic weaken, the impetus for recovery may soon appear.