Is China’s medical device industry really facing a “big test”?

Since the beginning of 2020, a serious disaster in human history—the COVID-19 has swept the world. During the epidemic, the demand for medical masks, surgical gowns, nucleic acid detection kit, ECMO and other medical devices has increased dramatically. Insufficient self-sufficiency in countries all over the world has turned their eyes to China, which is regarded as “World’s Factory”.

Although many factories have transformed to produce medical supplies, the huge demand from the world still makes some medical devices sold out. Relevant Chinese departments have also issued a number of policies to speed up approval, strengthen supervision, and ensure the safety of medical devices. It can be seen that the sudden outbreak is an “exam” for medical device companies. It is also an accelerator for the development of China’s medical device industry.

Policy supports the medical device industry. The market exceeded 600 billion yuan

The development of the medical device industry has to be combined with environmental factors. Compared with developed countries such as Europe and the United States, it is late for China to start up. The productivity is low and there is a lack of R & D personnel. At that time, most of them rely on domestic independent research, which took a long time. Therefore, China’s medical devices industry is relatively backward and the process is slow the early stages.

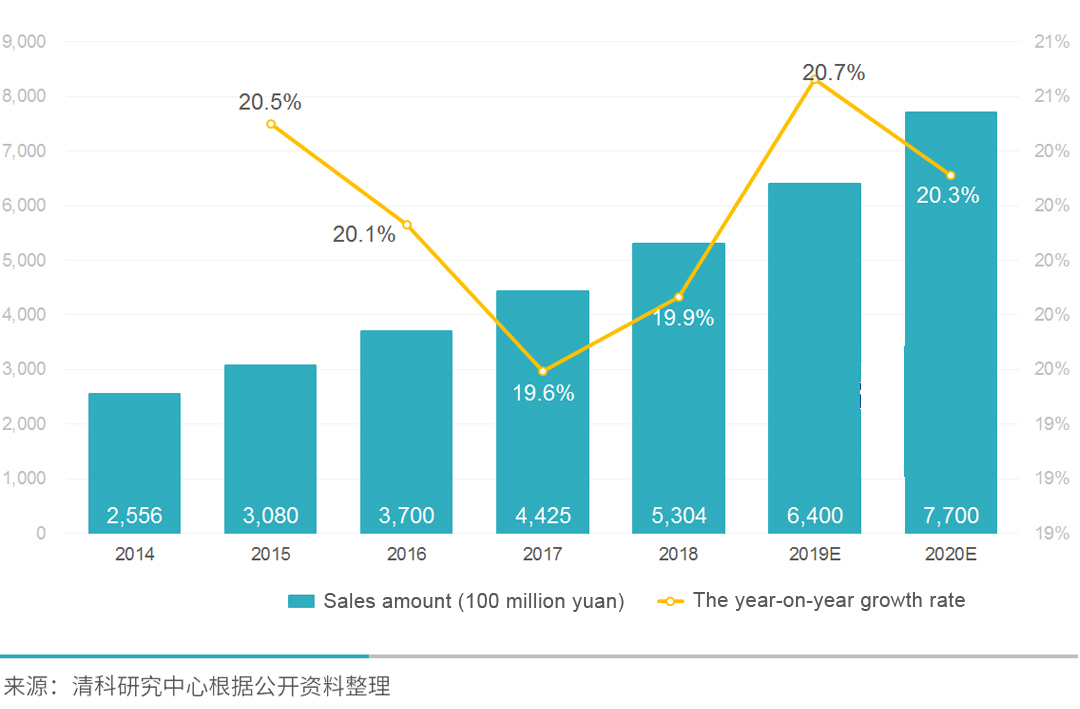

As the medical device policy environment improved, domestic independent innovation devices are increasingly produced. Capital helps the industry mergers and help the market to grow. According to the data from Zero2IPO Research Center, from 2014 to 2018, China’s medical device market continued to grow from 255.6 billion yuan to 530.4 billion yuan. The market scale doubled in five years, with an average annual growth rate of about 20.0%. The growth rate is estimated to be 770 billion yuan in China’s medical device market in 2020.

The industrial chain is relatively mature, but there are still deficiencies

Medical supplies have been a necessity for human survival since ancient times, so medical devices have always had a relatively mature industrial chain in the market. The upstream of the chain is the production of raw materials. The midstream is the processing for medical devices such as consumables, IVD Reagent, etc. The downstream is a variety of medical institutions, including public hospitals, small and medium-sized private hospitals, independent inspection institutions, and private customers and so on.

From all aspects, the development of the upstream of the medical device industry chain has gradually matured and developed fast. Raw materials will no longer depend on imports. Instead, domestic substitution is becoming the mainstream. For the midstream of the industry chain, the investment of R&D is still insufficient, which results in the lack of innovations. For the downstream, there is still a large expansion space. The demand for inspection devices, home medical devices, and rehabilitation devices is large because it adapts to the current healthy concept.

This situation is mainly affected by three factors. First of all, the demand for medical protection materials from hospitals and private businesses around the world during the epidemic makes it in need. Second, the policy requires the expansion of primary medical institutions and the demand for medical devices increases. Third, with the gradual deepening of the concept of a healthy life, people are paying more and more attention to health. The demand for medical examination institutions and home medical equipment is rising.

Enterprises in the expansion and maturity stagesare more optimistic, with Beijing, Shanghai, Guangdong occupying the main share

From 2014 to 2019, medical device companies in the expansion and maturity stages were more invested, with the number of corporate cases accounting for more than 64.3% and the investment amount accounting for more than 86.5%. The industry cluster is widely distributed and involves many provinces and cities in China. Relatively concentrated in Beijing, Guangdong, and Shanghai, the number of disclosed investment cases was 341, 268 and 265 respectively, totaling 874, accounting for 56.5% of the total number of investment cases.

On the whole, most of China’s active medical device companies are gathered in the eastern coastal areas. And their industry experience is more than 20 years. The main products are the subdivision fields of in vitro diagnostic preparations and testing instruments, medical imaging.

As the “world’s factory”, China’s medical device industry has huge potential and room to grow. First of all, since China’s reform and opening up, it has accumulated a wealth of material sources, manufacturing experience, and talents, which laid the foundation for the future development path. Secondly, the medical device industry chain is maturing. The upstream has been able to achieve self-sufficiency in some domestic raw materials, and the vigorous talent has led to a significant increase in research and development. At the same time, the concept of Chinese health care deepens, and people’s pursuit of health care has become a continuous driving force for the development of China’s medical equipment.