Impact of 2020 US election on financial markets

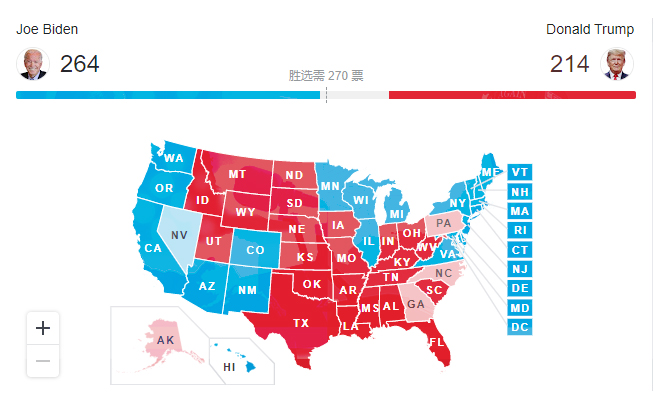

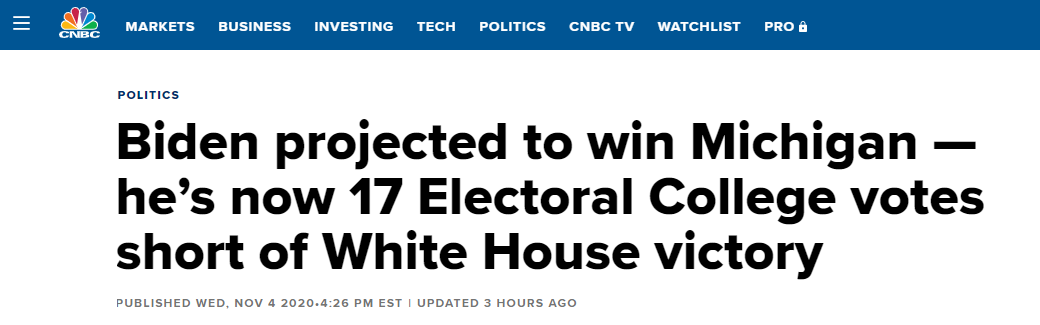

According to the current tally by NBC News, Biden’s projected victory in the state gives him 253 Electoral College votes. He needs 270 electoral votes to win, and now he’s 17 Electoral College votes short of White House victory.

As early as four years ago, Trump’s unexpected election caused market turmoil. Now again the election on the 3rd, investors are preparing for short-term trading shocks and long-term policy changes.

According to Reuters New York on November 2, Trump or Biden, who will enter the White House may be the turning point. Investors may face completely different developments in taxation, government spending, trade, and regulation in the United States.

In recent weeks, market trends have shown that investors’ bets will have a blue wave — that is, Biden’s election. Experts predict that those market trends include the yield curve and the depreciation of the US dollar (based on expectations that a fiscal stimulus plan will be introduced), as well as industries such as green energy and solar energy, which are expected to rise under Biden’s rule.

The situation seems to be traceable. From August to the end of October, a series of “Biden stocks” created by JP Morgan Chase rose 4.5%, while “Trump stocks” fell 16%. And just last week, the volatility of the stock market also made investors vigilant about the election results. They worry that while the number of new crown cases is rising, the fiscal stimulus will also fail.

According to previous polls, it is generally believed that the biggest hope for a large-scale stimulus plan comes from the victory of the Democrats. The stimulus package can revive the U.S. economy and stock markets that have been hit hard by the epidemic, rekindle the stock rotation that everyone has been waiting for, and make the trend of the depreciation of the dollar and the U.S. Treasury yield curve more obvious.

However, in addition to the short-term market boost, the election of Democratic will also cause many concerns for stock market investors. For instance, it is possible to increase the corporate tax from 21% to 28%, suppressing corporate profits, and heralding a stricter regulatory environment. On the contrary, if Trump wins the election and the Democratic dominates the House of Representatives, it will allow investors to believe the possibility of introducing a milder fiscal stimulus, while tax increases are unlikely.

Some analysts also pointed out that the bigger accident may be the “red wave”, that is, Republicans are elected president. The outside world believes that the possibility of such a situation is low, and this phenomenon may cause investors to abandon “deals” that favor Biden and turn to industries that benefit from Trump.

But it is sure that since Trump was elected president in 2016, U.S. stocks have risen by about 53% and have repeatedly set new highs. Trump’s corporate tax cuts have supported the stock market, and tariffs have triggered market volatility.