Biden’s $1.9 trillion rescue plan: What will be the global impact?

Biden proposed a $1.9 trillion COVID-19 relief bill, hoping to provide more aid to families and small businesses to deal with the pressure caused by the COVID-19.

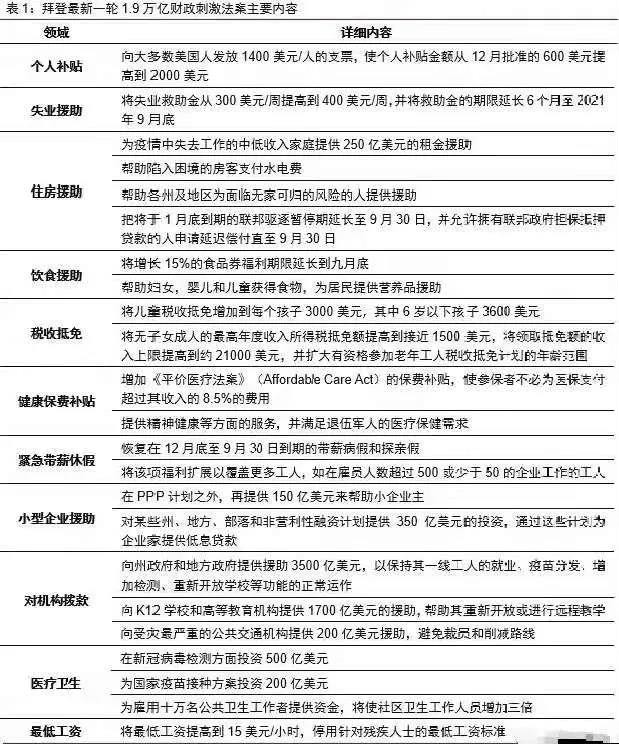

The whole plan aims to stabilize the economy and restore development. Specifically as follows:

It’s remarkable that it is only the first relief plan proposed by the Biden team. Another economic relief plan will be released in February, focusing on the long-term improving infrastructure, climate change, and promoting racial equality.

Is the era of inflation coming?

Judging from the relief plan, it looks like “dropping money”. The total federal debt of the United States has approached 28 trillion U.S. dollars, public debt has exceeded 100% of GDP, and the Fed’s balance sheet has exceeded 7.4 trillion U.S. dollars.

So where will the $1.9 come from? The answer is of course banknote printing.

Comparing the GWP (World GDP, also known as world gross domestic product) in 2019, the United States printed 3 trillion US dollars in March last year, which is equivalent to the one-year GNP (Gross National Product of the United Kingdom.

Where will the overprinted money eventually go?

Excessive printing money in a short period will quickly depreciate the national currency, and prices will also soar. But despite the crazy printing of money every year, the United States has maintained its price inflation level at around 2% since 2000. In the first few years of 2000, the United States even maintained zero inflation. The secret of low inflation is that dollar is the currency in circulation worldwide. The over-issued US dollars are not circulated in the domestic market but are sent to the world by the United States. In other words, inflation has also been transported to the world. The result is clear – we are likely to enter an era of price inflation.